Feeling a little uneasy about your money situation as we move through 2024? You are certainly not alone. Many folks, it seems, are starting to wonder if their net worth is, well, just too small. This idea of having "too short net worth 2024" can feel a bit heavy, like a weight on your shoulders, and it really just means having less money or assets than you might need or want for your life goals. It's a common concern, especially with how things are going in the world these days, you know?

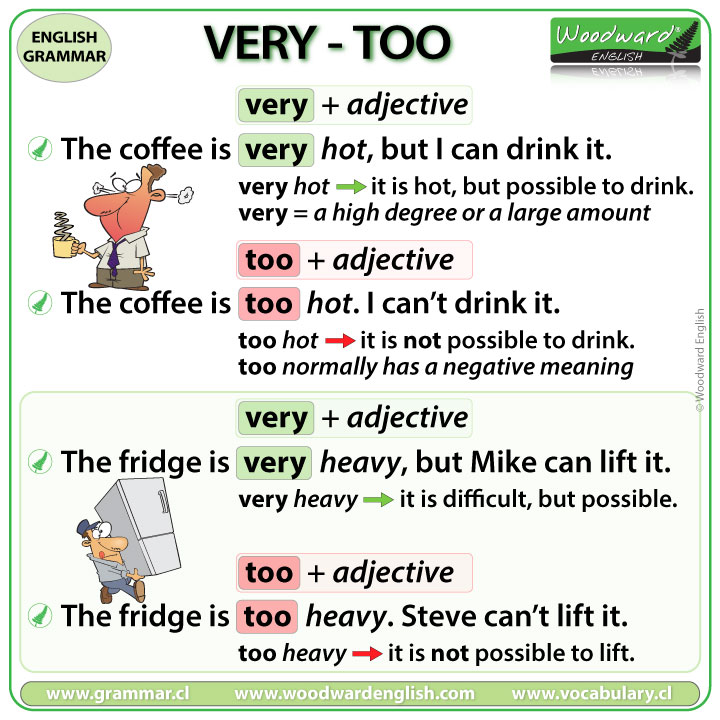

When we talk about something being "too" anything, it often means there's more of it than is suitable or enough, or perhaps in an excessive degree. So, when your net worth is considered "too short," it suggests it's less than what's fitting or desirable for your personal financial picture. It's a feeling that maybe you haven't saved enough, or your investments aren't growing fast enough, and that can be a bit worrying, actually.

This whole idea of a "too short net worth" is very much about how you feel about your own financial standing. It's not always about comparing yourself to others, though that can happen, but more about whether your current financial resources line up with your hopes and dreams for the future. Are you on track for retirement? Can you handle unexpected bills? These are the kinds of questions that pop up, and you might be thinking about them quite a bit, so.

Table of Contents

- What is "Too Short Net Worth" in 2024?

- Common Reasons for a Small Net Worth

- How to Assess Your Own Net Worth

- Practical Steps to Grow Your Net Worth

- Building a Stronger Financial Future

- Frequently Asked Questions

What is "Too Short Net Worth" in 2024?

When people talk about their net worth being "too short" in 2024, they're often thinking about whether their money pile is big enough for what they hope to achieve. It's not just about having a small number, but more about whether that number meets their personal needs and future plans, you know? This feeling can come from various places, like seeing higher prices for everything or just feeling behind on savings goals, so.

Understanding the Numbers

Your net worth is really just a simple calculation: everything you own (your assets) minus everything you owe (your liabilities). Assets include things like money in your bank accounts, investments, your home, and even your car. Liabilities are what you still have to pay off, like mortgages, credit card bills, and student loans. The result gives you a snapshot of your financial health at a given moment, and that's pretty much it.

For some, a "too short" net worth might mean having more debts than assets, resulting in a negative number. For others, it could be a positive number, but one that feels inadequate for retirement or a big purchase like a house. It's a very personal thing, and what feels "too short" to one person might be just fine for another, as a matter of fact.

Why It Feels "Too Short"

The feeling of a "too short" net worth in 2024 can come from a few different places. Maybe you're looking at the cost of living, which seems to keep going up, and your savings just aren't keeping pace. Or perhaps you've got some big dreams, like owning a home or traveling the world, and your current financial standing just doesn't seem to get you there, you know? These feelings are quite common, really.

Another reason for this feeling could be comparing your situation to others, or what you see online. It's easy to think everyone else has it all figured out, but that's rarely the full picture. The financial journey is different for everyone, and what matters most is your own path and progress, obviously.

Common Reasons for a Small Net Worth

There are many reasons why someone might find their net worth feeling a bit too small. It's often not about making bad choices, but more about the circumstances of life and the economy. Understanding these common reasons can help you feel less alone and start thinking about solutions, basically.

Student Debt and Loans

For many, student loans are a really big part of their financial picture, especially when starting out. While education is a great investment, the amount owed can really weigh down your net worth for years. It's like starting a race with a heavy backpack, and that can feel quite unfair, you know?

These loans can make it tough to save for other things, like a down payment on a house or even just building an emergency fund. They take a big chunk out of your monthly income, which means less money available to grow your assets. It's a common story for lots of people, as a matter of fact.

Living Costs and Inflation

The cost of just living your life seems to be getting higher and higher, doesn't it? From groceries to rent, everything seems to cost more than it used to. This rise in prices, what we call inflation, means your money doesn't go as far as it once did. So, even if your income stays the same, your purchasing power goes down, and that can make your net worth feel smaller, very much so.

When daily expenses eat up a larger part of your income, there's less left over to save or invest. This can make it hard to build up your assets, and it's a challenge many people are dealing with in 2024, to be honest.

Unexpected Expenses

Life has a way of throwing curveballs when you least expect them. A sudden car repair, a medical bill, or a home emergency can really set you back financially. These unexpected costs can quickly wipe out savings or force you to take on new debt, pushing your net worth down. It's like trying to fill a bucket with a hole in it, you know?

Without a solid emergency fund, these surprises can have a pretty big impact on your financial standing. They can make you feel like you're constantly playing catch-up, and that's not a fun feeling at all, you know?

How to Assess Your Own Net Worth

Figuring out where you stand financially is the first step to making things better. It's not about judging yourself, but just getting a clear picture. Once you know your numbers, you can start making a plan, and that's a good thing, really.

Calculating Your Financial Picture

To get your net worth, you just list all your assets and all your liabilities. Assets include your checking and savings accounts, investment accounts (like 401ks or IRAs), any real estate you own, and even the value of your car. Then, list your liabilities: credit card debt, student loans, car loans, and your mortgage, if you have one. Subtract the total liabilities from the total assets, and there you have it, your net worth. It's a pretty straightforward calculation, actually.

Doing this exercise can be quite eye-opening. You might find you're in a better spot than you thought, or it might confirm your feeling that your net worth is a bit too short. Either way, having this number gives you a starting point, which is really what you need, so.

Setting Realistic Targets

Once you know your current net worth, you can start thinking about where you want it to be. It's important to set goals that are reachable and make sense for your life. Don't compare yourself to billionaires, but think about what would make you feel secure and comfortable. Maybe it's having enough for a down payment, or a certain amount in your retirement fund, you know?

Break down your bigger goals into smaller, manageable steps. This makes the whole process feel less overwhelming and more achievable. Celebrate the small wins along the way, because every bit of progress counts, honestly.

Practical Steps to Grow Your Net Worth

If your net worth feels too short, the good news is there are many things you can do to change that. It takes time and effort, but even small changes can add up over time. It's all about making smart choices, you know?

Boosting Your Income

One of the most direct ways to increase your net worth is to bring in more money. This could mean asking for a raise at your current job, taking on a side gig, or even learning new skills that could lead to a better-paying role. Every extra dollar you earn can be put towards savings or investments, which really helps your net worth grow, you know?

Consider what unique talents or knowledge you have that could be turned into an extra income stream. Even a few hours a week doing something you enjoy can make a noticeable difference over a year. It's worth exploring, really.

Managing What You Spend

Just as important as earning more is making sure you're smart about how you spend your money. Taking a close look at your expenses can reveal areas where you might be able to cut back. This doesn't mean depriving yourself, but rather making conscious choices about where your money goes. It's about being more intentional, basically.

Try tracking your spending for a month or two. You might be surprised where your money is actually going. Little things, like daily coffee runs or subscriptions you don't use, can add up to a lot over time. Finding ways to reduce these can free up cash for your financial goals, and that's a pretty good thing, you know?

Smart Saving Habits

Building a strong net worth definitely involves saving money regularly. Try to automate your savings, so a set amount moves from your checking account to your savings or investment account each payday. This makes it easier to stick to your plan, because you don't even have to think about it, you know?

Start with an emergency fund, aiming for at least three to six months of living expenses. This safety net can prevent you from going into debt when unexpected things happen, which really protects your net worth. It's a very important step, honestly.

Investing for the Future

Once you have some savings, investing is how you make your money work for you. Even small amounts invested consistently over time can grow significantly thanks to compounding. This means your earnings start earning their own money, which is pretty cool, right?

There are many ways to invest, from retirement accounts like 401ks and IRAs to simpler options like low-cost index funds. If you're new to investing, consider talking to a financial advisor or doing some research to understand your options. Learning more about investing strategies can really help you get started, so.

Building a Stronger Financial Future

Feeling that your net worth is "too short" in 2024 is a feeling many share, but it's also a powerful motivator for change. By taking a clear look at your current financial situation, understanding why it might feel insufficient, and then taking practical steps to improve it, you can definitely move towards a more secure financial future. It's about making small, consistent efforts that add up over time, you know?

Remember, your financial journey is unique to you. Focus on your own goals and progress, rather than comparing yourself to others. Every step you take, no matter how small, is a step towards a healthier financial picture. You can learn more about what net worth means and how it's calculated. Building your net worth is a marathon, not a sprint, and with steady effort, you can absolutely get where you want to be. And you can also link to this page for more tips on managing your money, too it's almost.

Frequently Asked Questions

What is a good net worth for my age in 2024?

There isn't one perfect number, as it really depends on your life circumstances, where you live, and your personal goals. However, many financial planners suggest aiming to have a net worth equal to your annual salary by age 30, and then increasing it steadily from there. But honestly, it's more about personal progress than hitting a specific number, you know?

How can I increase my net worth quickly?

While there's no magic trick, increasing your net worth quickly usually involves a combination of earning more money and significantly reducing what you spend. Paying down high-interest debt, like credit card balances, can also make a big difference very fast, as it stops that money from just disappearing. It's about being very disciplined for a period, so.

Is it normal to have a negative net worth?

Yes, it's actually quite common, especially for younger people or those with significant student loan debt or a new mortgage. A negative net worth just means your liabilities are currently greater than your assets. It's a starting point, not a permanent state, and many people work their way out of it over time, you know? It's really just a snapshot.

Detail Author:

- Name : Alena Cruickshank

- Username : harold11

- Email : waters.angelica@gmail.com

- Birthdate : 1979-07-26

- Address : 22484 Swaniawski Ferry Eddiehaven, GA 25218-9283

- Phone : 507.481.8261

- Company : Buckridge, Koss and Lebsack

- Job : Zoologists OR Wildlife Biologist

- Bio : In architecto eligendi et ut incidunt quo numquam. Soluta maxime voluptate sit quia ex.

Socials

instagram:

- url : https://instagram.com/enrico_real

- username : enrico_real

- bio : In suscipit ducimus qui quasi sequi et aut ut. Nisi iusto aspernatur ad totam praesentium eaque.

- followers : 4665

- following : 239

linkedin:

- url : https://linkedin.com/in/ebrekke

- username : ebrekke

- bio : Nemo nesciunt suscipit aliquid non.

- followers : 254

- following : 922

twitter:

- url : https://twitter.com/enrico_brekke

- username : enrico_brekke

- bio : Odio nostrum aut molestiae in nobis. Sint harum et sequi ut quas eveniet. Quis dicta facere velit velit. Consequatur doloribus eveniet ut nam voluptatem.

- followers : 4887

- following : 2579