Have you ever felt a little uneasy about your money situation, wondering if you have enough, or if you are, well, a bit behind?

It's a common thought, that, especially when you see what others might have or hear about big financial goals. Many folks, quite honestly, think about their financial health and whether their savings and assets truly measure up. It's a question that can spark some worry, or perhaps, just a desire to get things more in order, you know?

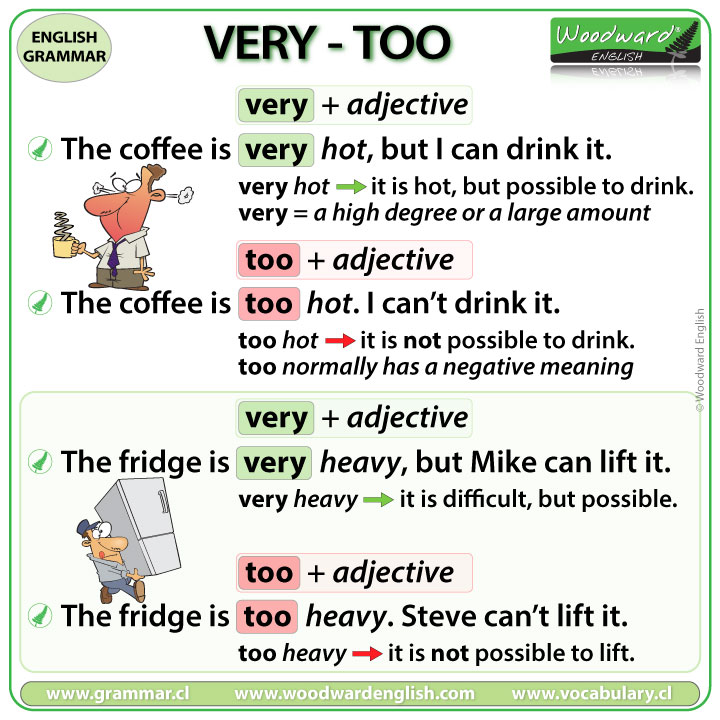

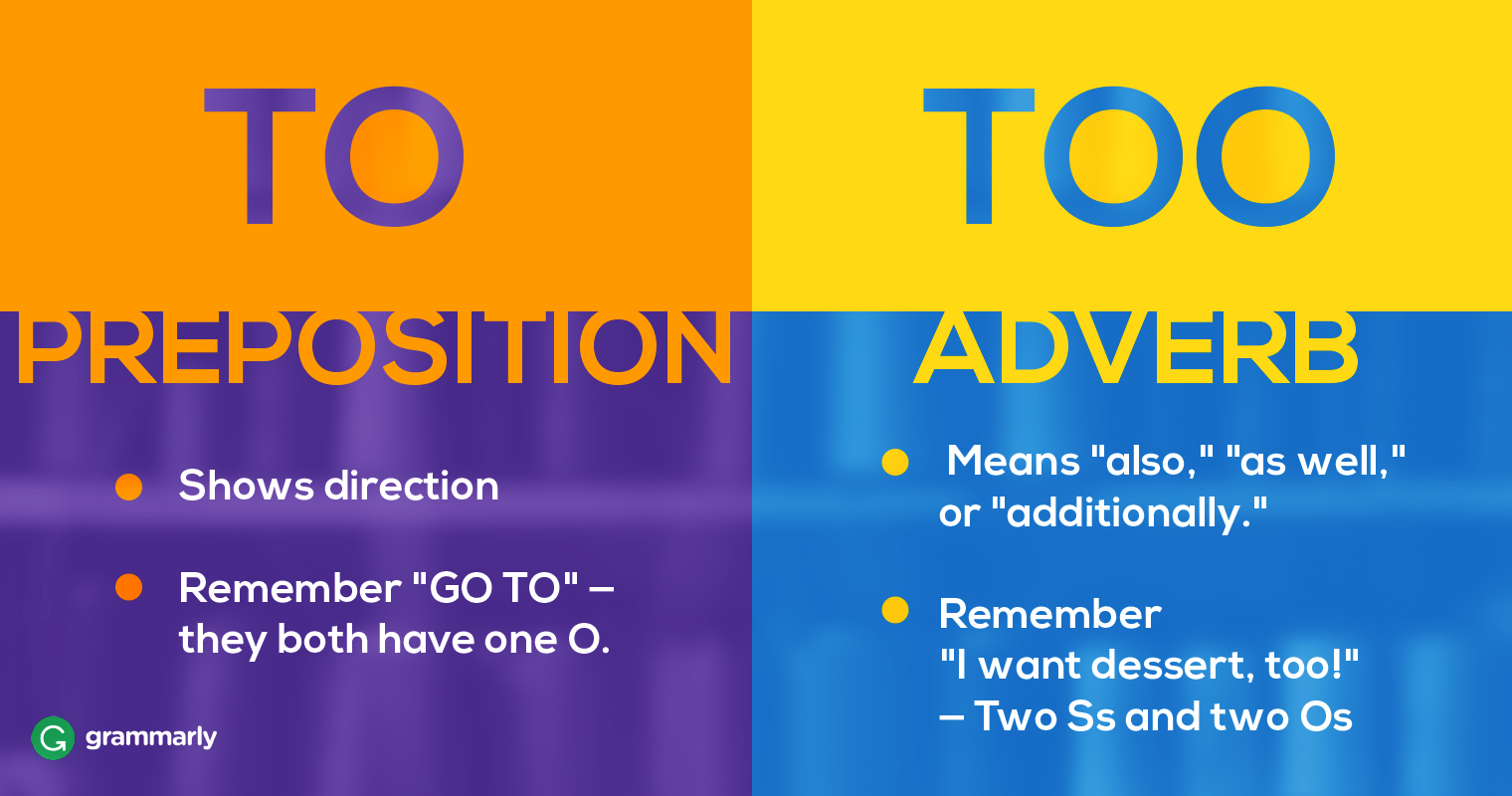

Figuring out what "too short net worth" really means for you can feel a little like trying to understand the difference between "to" and "too"—as my text mentions, these words sound the same but mean very different things, especially when one implies "more than is needed or wanted" in an excessive way. In the same vein, a "too short" net worth isn't just about having less, it's about having less than what's suitable or enough for your life's goals, and that, is a rather important distinction.

Table of Contents

- Understanding What Net Worth Really Means

- What Makes a Net Worth "Too Short"?

- Signs Your Net Worth is Too Short

- Average Net Worth by Age and What It Suggests

- How to Figure Out Your Own Net Worth

- Steps to Improve Your Net Worth

- FAQ About Net Worth

- Taking Charge of Your Financial Future

Understanding What Net Worth Really Means

Your net worth, basically, is a simple snapshot of your financial health at any given moment. It’s the total value of everything you own—your assets—minus everything you owe, which are your liabilities. Think of it like this: your house, your car, money in savings, investments, even your retirement accounts are all assets, you know? These are the things that hold value and, in some cases, can grow over time. They represent your financial holdings, more or less, and that, is a pretty important side of the equation.

Then, we have liabilities. These are the financial obligations, the money you still need to pay back. Things like your mortgage, car loans, credit card balances, student loans, and any other outstanding bills fall into this category. They are debts that reduce your overall financial standing. The number you get after subtracting what you owe from what you own gives you your net worth, and that, is a pretty clear picture of where you stand right now.

A positive net worth means you own more than you owe, which is generally a good sign. It shows that your assets are building up and, in a way, you are making progress. This positive number can grow steadily over years of careful money management. It's the goal for most people, you see, to have more coming in and staying put than going out in payments.

A negative net worth, on the other hand, means your debts are greater than your assets. This is, quite honestly, a common starting point for many, especially young adults just out of school with student loans, or those buying their first home with a large mortgage. It’s not necessarily a bad thing at first, but it's something you typically want to change over time. The aim is to reduce those liabilities and build up your assets so that your net worth eventually becomes a positive number, and then, keeps growing, you know?

Understanding this basic calculation is the first big step. It helps you see where your money is, and where it's going. It’s a foundational piece of financial wisdom, really. Knowing this number can help you make better choices for your financial future, which, in some respects, is very empowering.

What Makes a Net Worth "Too Short"?

Defining "too short net worth" isn't a one-size-fits-all answer, honestly. It's not just about a specific dollar amount, because what's enough for one person might be completely different for another. It's rather like trying to fit a square peg into a round hole if you just pick a number. Instead, it's more about whether your current financial standing is enough to support your present life and your future aspirations, and that, really changes from person to person.

Think about it: your net worth needs to be "enough" for your unique path. This means it should allow you to handle daily expenses, cover unexpected costs, and work towards your long-term goals. If it feels like your financial resources are constantly stretched thin, or if you can't seem to get ahead, then your net worth might be a bit too short for comfort, you know? It's about feeling secure and having room to breathe financially, you see.

The feeling of a "too short" net worth often comes from a mismatch between your financial reality and your personal expectations or needs. It's a very personal metric, really. What one person considers a comfortable amount, another might find insufficient. This is why looking at averages, while sometimes helpful, isn't the whole story. Your individual situation and what you hope to achieve are truly what matter most, you know?

Age and Life Stage Matter

Someone just starting their career in their twenties, for example, will likely have a very different net worth than someone nearing retirement in their fifties. It's pretty normal for younger people to have less saved, and perhaps more debt from education or starting a home. This is a common part of the financial cycle, you see. Their assets are just beginning to build, and that, is perfectly fine for their stage of life.

As people get older, the expectation, generally, is to have accumulated more assets and paid down more liabilities. A net worth that's considered "too short" for a 50-year-old, who might be planning for retirement soon, would be perfectly acceptable for a 25-year-old who is just getting started. It's all about context, you know? Your age and where you are in your life journey play a really big part in what's considered an appropriate net worth.

So, when you consider your own net worth, think about your age group. Are you just starting out, building a family, or looking towards retirement? Each stage has different financial demands and, therefore, different benchmarks for what constitutes a healthy net worth. It's a bit like comparing apples and oranges if you don't consider the life stage, you see.

Your Goals and Dreams

What are your big plans? Do you dream of owning a home, sending kids to college, traveling the world, or retiring early? Your net worth needs to be on a path to support these aspirations. If your current financial picture doesn't seem to be moving you closer to these important life goals at a reasonable pace, then your net worth might be considered "too short" for your personal vision, you see. It's about alignment, more or less.

If you have ambitious goals, like retiring by age 50 or buying a vacation home, your net worth will need to grow more quickly than someone with simpler aspirations. This means your current savings and investments need to be on track to meet those bigger targets. If they are not, then your net worth, in relation to your dreams, could be seen as "too short." It's a clear signal to adjust your financial strategy, you know?

Having a net worth that matches your goals gives you a sense of purpose with your money. It means your financial efforts are truly working for you, helping you build the life you imagine. If there's a disconnect, where your goals are big but your net worth is small and not growing fast enough, that, too, can create a feeling of being behind. It's about setting realistic expectations and then working to meet them, you see.

Unexpected Bumps in the Road

Life, as we know, throws curveballs. Having a net worth that's too short can mean you're not ready for unexpected expenses like a sudden job loss, a medical emergency, or a major car repair. A healthy net worth provides a cushion, a sense of security, which, in some respects, is truly priceless. If you find yourself constantly worried about

Detail Author:

- Name : Gudrun Kutch

- Username : hassan43

- Email : murazik.chadrick@gmail.com

- Birthdate : 1984-11-28

- Address : 972 Trenton Squares Apt. 774 Deckowberg, MA 17833

- Phone : 1-765-823-8664

- Company : Lind-Block

- Job : Movers

- Bio : Sed magni libero perferendis dolores ratione dolorem. Repellat quae quia quia ex ut eos. Aut qui et aperiam amet quo. Est repellat cum magnam.

Socials

twitter:

- url : https://twitter.com/nolan_tillman

- username : nolan_tillman

- bio : Sapiente iste eligendi ut reprehenderit laboriosam recusandae. Qui qui ut eum adipisci iste aspernatur aperiam.

- followers : 3267

- following : 2655

instagram:

- url : https://instagram.com/tillmann

- username : tillmann

- bio : Enim laboriosam soluta error dignissimos. Eveniet minus culpa porro cupiditate aliquid.

- followers : 1985

- following : 2582

facebook:

- url : https://facebook.com/ntillman

- username : ntillman

- bio : Nobis incidunt beatae ratione repudiandae fugit consequatur placeat quas.

- followers : 3774

- following : 1343

linkedin:

- url : https://linkedin.com/in/nolan_real

- username : nolan_real

- bio : Ex sequi architecto dolorem mollitia sed beatae.

- followers : 5570

- following : 2607